Is your current mortgage weighing you down with high interest rates? You’re not alone. Millions of American homeowners refinance their mortgage each year to save money, tap into equity, or change their loan terms.

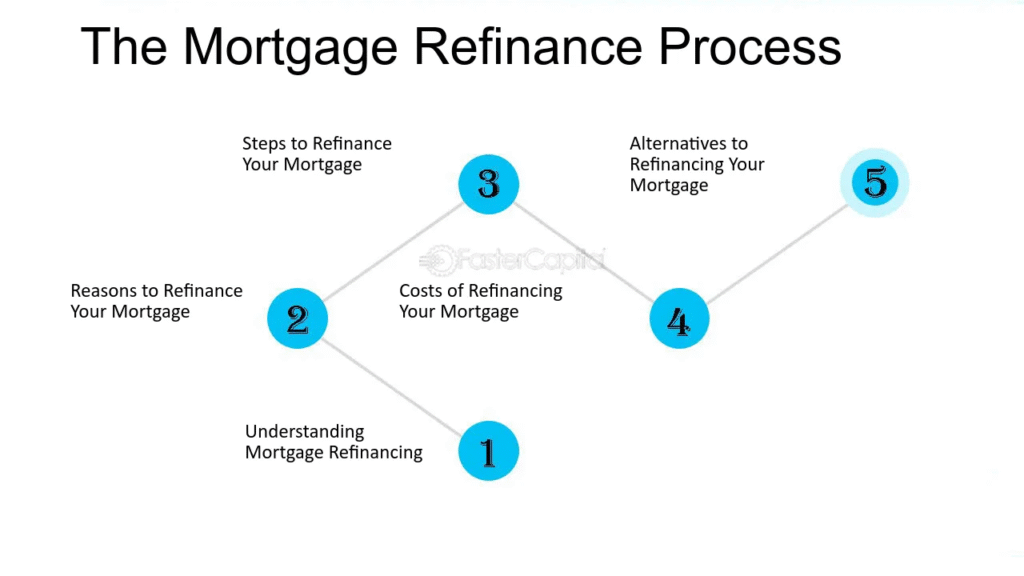

This comprehensive guide will walk you through the entire process of how to refinance a mortgage in the USA, from determining if it’s right for you to closing on your new loan. We’ll break down the complex jargon into simple, actionable steps.

What Does It Mean to Refinance Your Mortgage?

Mortgage refinancing is the process of replacing your existing home loan with a new one. The new loan pays off the original mortgage, and you begin making payments on the new terms. People refinance for various reasons, which we’ll explore next.

Top Reasons to Refinance Your Home Loan

Understanding your “why” is the first step. Here are the most common goals for a refinance:

- Lower Your Monthly Payment: Securing a lower interest rate is the primary driver for most homeowners. Even a drop of 0.5% can lead to significant savings over the life of the loan.

- Shorten Your Loan Term: Switch from a 30-year mortgage to a 15-year mortgage to build equity faster and pay off your home sooner, often at a lower interest rate.

- Cash-Out Refinance: Tap into your home’s equity to get cash for major expenses like home renovations, debt consolidation, or college tuition.

- Switch from an ARM to a Fixed-Rate: If you have an Adjustable-Rate Mortgage (ARM) and want the stability of a fixed interest rate, refinancing is the way to go.

- Remove FHA Mortgage Insurance: If you have an FHA loan and have built up at least 20% equity, refinancing to a conventional loan can eliminate mandatory mortgage insurance premiums (MIP).

Step-by-Step: The Mortgage Refinance Process

Step 1: Define Your Goal and Check Your Finances

Before you shop, know your objective. Is it lowering payments? Cashing out? Then, check your credit score. Your credit health is the most critical factor in qualifying for the best rates. Aim for a score of 740 or higher for optimal terms. Review your debt-to-income ratio (DTI) and ensure your income is stable.

Step 2: Research and Compare Lenders

Don’t settle for the first offer you get! Shop around for the best mortgage refinance rates. Get quotes from at least three different types of lenders:

- Big national banks (e.g., Bank of America, Wells Fargo)

- Credit unions (often offer competitive rates to members)

- Online mortgage lenders (e.g., Better.com, Rocket Mortgage)

- Local mortgage brokers

Compare the Annual Percentage Rate (APR), which includes the interest rate and fees, to get a true cost comparison.

Step 3: Get Your Documents in Order

Lenders will require extensive documentation to verify your financial situation. Gather these items:

- Proof of income (W-2s, pay stubs, tax returns)

- Proof of assets (bank and investment account statements)

- Information on your existing mortgage

- Homeowners insurance information

Step 4: Get a Home Appraisal

Your lender will order an appraisal to determine the current market value of your home. This is crucial because your home equity (home value minus mortgage balance) determines your new loan terms and whether you qualify for a cash-out refi. A higher appraisal value is beneficial.

Step 5: Underwriting and Conditional Approval

The lender’s underwriting team will meticulously review your application, documents, and appraisal. They may ask for additional documentation before granting final approval.

Step 6: Close on Your New Loan

Once cleared to close, you’ll sign the final paperwork. After a three-day rescission period (required by law for refinances), your new loan will pay off your old one, and you’ll start making payments on the new mortgage.

Key Costs of Refinancing: Closing Costs Explained

Refinancing isn’t free. Typical mortgage refinance closing costs range from 2% to 5% of the loan amount. These fees can include:

- Application Fee

- Loan Origination Fee

- Appraisal Fee

- Title Search and Insurance

- Attorney Fees

- Recording Fees

Pro Tip: Calculate your break-even point—the time it takes for your monthly savings to exceed the closing costs. If you plan to move before hitting the break-even point, refinancing may not be worth it.

Break-Even Formula: Total Closing Costs / Monthly Savings = Number of Months to Break Even

Current Mortgage Refinance Rates Trends (2024)

Mortgage interest rates are constantly in flux, influenced by the Federal Reserve, inflation, and the broader economy. As of 2024, rates have been higher than the historic lows of 2020-2021 but may stabilize.

To find today’s best rates, use online comparison tools and talk to lenders directly, as your personal rate will depend on your credit, location, and loan-to-value ratio.